Imagine settlement costs and you can charges, that can without difficulty start from 2% so you’re able to six% of your the new loan amount

Refinancing mortgage is the process of getting a different home loan so you’re able to replace your current that. People generally love to re-finance for many key explanations, like protecting a lesser interest rate or payment, transforming house equity towards the bucks (cash-away refinancing), or modifying the financial variety of otherwise identity.

- Choose why you should refinance. Are you currently planning no wait loans Fruithurst AL to decrease your monthly premiums, reduce your loan label, button of a varying-speed to help you a predetermined-price home loan, otherwise utilize home guarantee? Your respond to have a tendency to considerably feeling and that supplier you focus on and you can the refinancing processes progresses.

- Check your credit score and records. The greater your credit rating, the much more likely you are to locate a great interest. Make certain all guidance on your own credit report is actually perfect, and take strategies to improve your borrowing from the bank (eg paying personal debt) before applying.

- Determine their home’s equity. If you have gathered extreme security of your house, you will be very likely to qualify for refinancing. Lenders generally need residents to hold at the very least 20% security shortly after refinancing.

- Research rates to find the best prices. Contact multiple lenders to compare their attention pricing and you can financing terms and conditions. Doing this can help you find a very good price and also have a feel which companies are an easy task to manage.

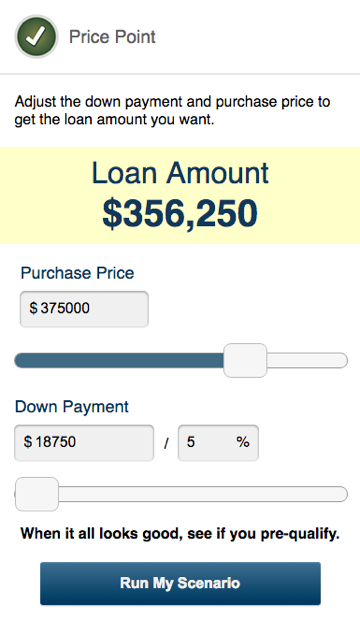

- Apply for the fresh mortgage. Once you’ve chosen a loan provider, you’ll be able to complete an application with information regarding your earnings, property, and debts. Depending on how much you may be credit as well as your mortgage form of, their financial may buy a house appraisal to choose their residence’s newest worth. you will need certainly to consult a payoff matter from the current bank so your brand new lender include they on the new financing closure.

- Intimate on the the newest loan. When your application is recognized, you’ll personal towards the the brand new loan. This may pay any outstanding harmony on your own old financial. After that submit, you’ll only make costs in your the newest home loan.

Think about, if you find yourself refinancing provide economic positives, it is far from the best choice for everyone. Also remember one to refinancing resets the term in your loan, so you could be required to make payments more than your would have or even.

Style of mortgage re-finance

To have residents contemplating refinancing, several options arrive, each made to fulfill diverse financial desires and you will conditions. These include rate-and-label refinancing, cash-out refinancing, and cash-during the refinancing. Knowing the differences when considering these types of choices is critical to choosing the right one which works for you.

Price and you can name re-finance

A performance and label re-finance is a type of refinancing mortgage in which a debtor uses another type of loan so you’re able to secure a different rate of interest and you will/otherwise term for their financial. In the an increase and you can label re-finance the primary quantity of the new financial will not change. Instead, the new financial terminology end in a much better rate of interest, the fresh repayment period, and you may possible discounts inside the monthly mortgage payments.

A rate and you will title refi is ideal for home owners which have a secure earnings, regular a position, and no intentions to offer their houses in the near future. It is also including beneficial for whoever has taken actions to improve its credit once the securing the brand spanking new mortgage, as they are prone to discover less interest rate. However, refinancing constantly has initial settlement costs, very consumers would be to weigh the fresh related costs and you will deals before making a decision whether or not an increase and you can term re-finance is good to them.

Cashout re-finance

An excellent cashout refinance are a home loan which enables homeowners so you’re able to acquire extra cash than simply it owe on their established mortgage, shielded because of the collateral they have produced in their residence since taking right out the initial financial. That one gift ideas an effective opportunity for homeowners to help you make use of this new collateral he has accumulated within residential property and employ you to currency to fund expenses, pay off high-interest debt, fund home renovations, otherwise purchase.