An educated Mortgage brokers to possess Lower-Earnings Unmarried Mothers

When you are an individual mommy traditions into a restricted income, you have possibilities that will help make think of homeownership possible. Lenders for lowest-income solitary mothers may include regulators-backed home loan possibilities such as for example FHA loans and you can USDA money. If you are striving on one money, you can also qualify for downpayment direction that can help your save money to place down while also fulfilling your own plus baby’s demands.

- An informed Lenders to own Low-Income Unmarried Mothers

- FHA Fund

- USDA Money

- Come across All 20 Things

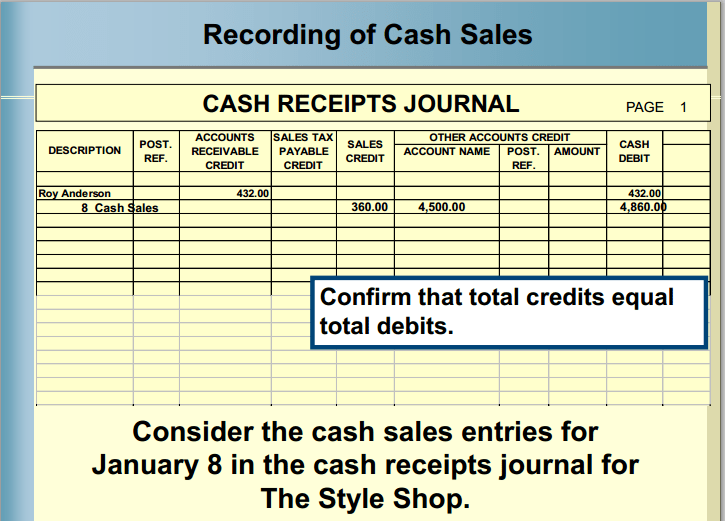

Government-recognized home loan options are prominent lenders to have solitary moms and dads as they has actually lower down fee and you will credit requirements. Government-recognized mortgages enjoys insurance away from certain twigs of federal regulators, and thus loan providers may offer them looser qualification conditions when put next so you’re able to conventional loans. Probably the most common choices for single parents into the an excellent tight budget to locate a mortgage loan is:

FHA Loans

FHA fund was supported by the new Federal Housing Administration, that’s an element of the Company away from Casing and you can Metropolitan Development (HUD).