All you have to Discover Loan mod from inside the Illinois

Money are useful to possess business ventures, debt consolidation reduction, and you can investments. Loans is actually debts obtain by the one and other organization. It is the money given to other team inturn to possess fees of the financing principal matter as well as focus. Referring in almost any versions and covered, unsecured, industrial, and personal loans. It can be secured by the security such home financing otherwise it may be unsecured like credit cards.

Generally, the bank while the borrower have to buy into the terms and conditions and you may standards of your own financing. loans with no credit check in Goodwater It provides the borrowed funds amount, the maximum amount of interest, guarantee, homeloan payment package, and you can period of payment date before releasing any amount of money.

When you find yourself struggling to repay your mortgage with respect to the amazing mortgage fee agreement, you can attempt filing for financing amendment. The purpose of financing amendment should be to assist a citizen get caught up on the earlier-owed mortgage repayments and steer clear of foreclosures. The content commonly address the following issues to help you discover how loan mod works:

- How do i Rating a mortgage Modification?

- What is actually financing Modification?

- How can i Be eligible for a mortgage loan Modification?

- Do you know the Different Financial Modification Applications?

- How can i Submit an application for financing Modification?

- How can i Avoid Loan modification Scams?

How can i Score a mortgage loan Modification?

When you are trailing to the home loan repayments on account of financial troubles, losses mitigation makes it possible to remain on top of loan repayments and you may opt for household foreclosure prevention . Loss mitigation is the procedure of trying protect residents and you can home loan customers away from foreclosures. Both parties can transform financing conditions, workout a great refinance bundle, stretch along payment, or deal with numerous different ways to keep the financial undamaged. It can help you and your mortgage servicer create unpaid mortgage loans. Check out of your loss minimization alternatives to pick:

- Mortgage loan modification

- Brief Conversion

- Installment Plan

What is a loan Modification?

A loan modification is among the most preferred sort of losings mitigation. Even if a loan amendment are designed for whichever loan, he is most typical having secured personal loans for example mortgage loans. Using this procedure, good homeowner’s financial was changed, which have the financial and you can resident getting bound to the latest mortgage words. Mortgage loan modification is designed to help make your mortgage repayments more affordable.

Once you endeavor financially assuming you neglect to pay off your financing according to unique commission arrangement, it is possible to consult a loan modification. It requires a change to the first regards to your loan. It might encompass an extension of time for repayment, reduced total of interest rate, otherwise a modification of the sort of loan. It may be an effective choice to ease the burden and you will avoid losing your home. A loan modification procedure is going to be understood with the help of an effective Skokie bankruptcy attorney .

How do i Be eligible for a mortgage Amendment?

The fresh qualifications and requirements having a mortgage amendment can vary according to advice of one’s home loan company additionally the kind of out-of mortgage. They truly are according to the matter that you owe, the property used having collateral, and you can specific attributes of this new equity property. To help you qualify for a home mortgage amendment, you really need to show that:

Up until the recognition out of that loan amendment, you will want to experience a try several months bundle (always 3 months) to display that you can spend the money for modified matter underneath the the fresh financial terms and conditions.

Which are the Other Financial Modification Software?

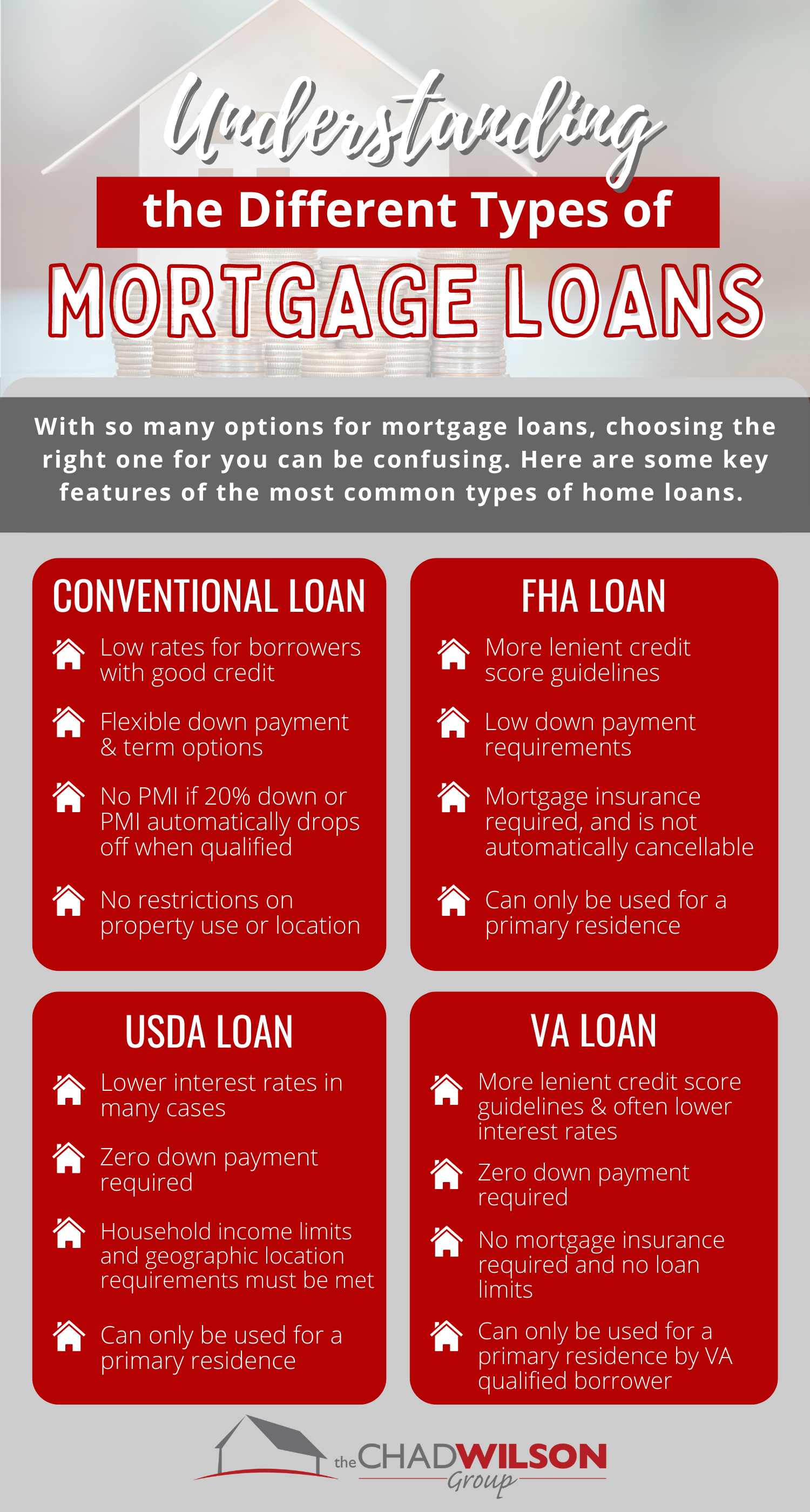

When you are incapable of build your home loan repayments, speak to your mortgage lender otherwise servicer instantly and ask regarding your selection. Now, extremely loan providers and you will servicers render certain mortgage loan modification assistance apps . Additionally, you can be eligible for a government loan modification system dependent on brand new situation and type of home loan. Several options shall be provided to possess consumers which have Federal national mortgage association or Freddie Mac computer, VA-secured, FHA-covered, and you can USDA mortgages. Such, in the event the financial try had otherwise guaranteed because of the possibly Fannie mae otherwise Freddie Mac, you .

How to Submit an application for a loan Modification?

An interest rate modification software will need you to claim your own monetary information (proof of money, auto loan, otherwise credit debt), home-based home loan advice, and the information on brand new hardship situation. To try to get a home loan amendment, you need to get in touch with their servicer’s family preservation department to request loss mitigation. And include another facts on your application:

How do i Avoid Loan mod Frauds?

Property owners that stressed and financially troubled is the purpose from ripoff musicians off other mortgage amendment businesses. To stop frauds, it is advisable to search judge help from a reliable Skokie bankruptcy proceeding lawyer to most readily useful see the process of financing amendment. Be suspicious of loan modification enterprises otherwise financing establishments which can guarantee a great bailout that music too-good to be true. They’re going to charge you for different functions you’re able to do to your their. This type of fraudsters simply assemble your loan modification application data files out-of both you and fill in them to their home loan or loan servicer.

This new Character regarding a case of bankruptcy Attorneys inside the Loan modification

Obtaining a loan modification are going to be challenging, confusing, and day-drinking particularly if you do not have sufficient degree from losses mitigation regulations and the loan modification techniques. For this reason, employing our very own experienced Skokie bankruptcy proceeding lawyer at the Cutler Personal bankruptcy, LTD can ease the load. I will be in a position to go through all of the documents you you need, make sure that the new records is done and you may correct to cease punishment and denial. We will make it easier to comprehend the different loan mod alternatives, create an action plan, and you can negotiate mortgage words with your lender.